Medicaid Care Planning with an Elder Law Attorney

Learn how an elder care attorney can help you create a strategy to provide asset protection and access to long-term care with Medicaid planning.

Scammers Try to Trick Seniors with Medicare

The federal government is warning people with Medicare about scam artists offering ‘free’ COVID-19 tests.

What If I Become a ‘Sudden’ Caregiver?

While the sudden caregiver has no preparation, no warning signs or slow changing of circumstance, the long-term caregiver certainly experiences situations of crisis.

Use Estate Planning to Prepare for Cognitive Decline

Data from sources like the U.S. Census Bureau shows in no uncertain terms that the U.S. population has grown older over the prior two decades.

Should I Enroll in Medicare Before I Retire?

A recent survey found that a third of those nearing retirement age (62-64) who plan to keep working past 65 don’t understand they can sign up for what is often more affordable Medicare coverage, even while they’re still employed. Kiplinger’s recent article, “Yes, You Can Sign Up for Medicare While You’re Still Working,” says that with retirement further away for many, some people must get some help understanding their options. The article answers some common questions concerning retirement postponement and Medicare coverage, including common misperceptions. Your retirement decision is personal and dependent on your situation. Access to health coverage is…

How Do I Set Up an Estate Plan to Help Grandchild with Special Needs?

Estate planning is not a requirement. No one can force you to make your will, create a power of attorney or to own your property in a way to avoid probate. As a result, people too often let common estate planning excuses stand in their way.

What Is Multigenerational Estate Planning?

When multiple generations live on the same property, issues over ownership, who inherits what and who provides what can get complicated fast.

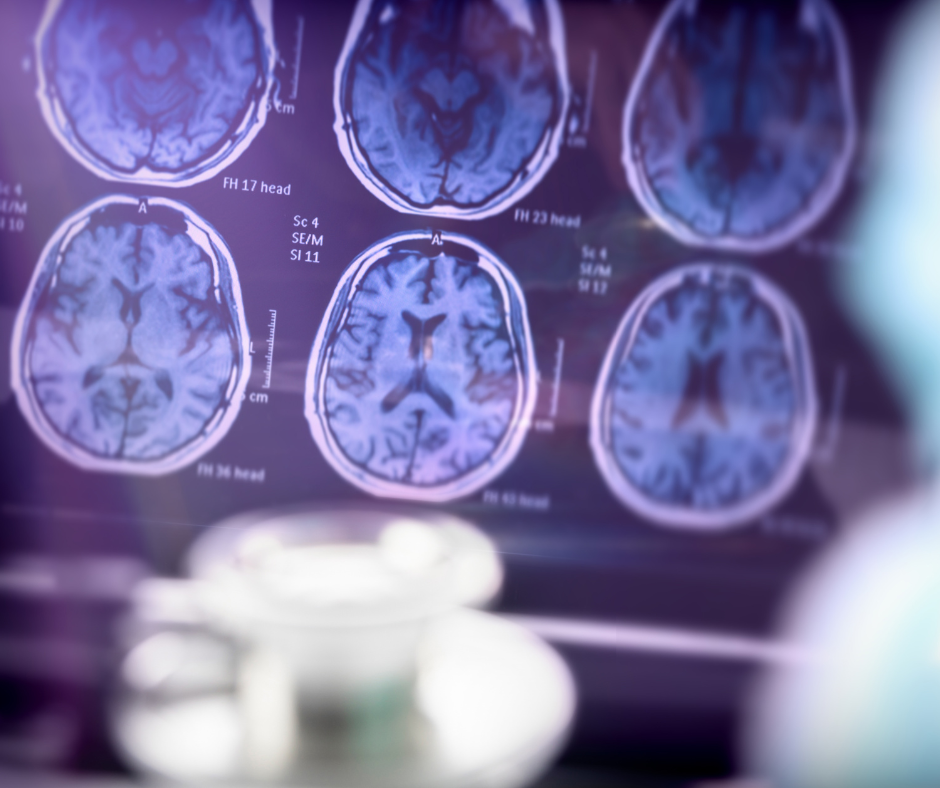

What’s the Latest News in the Fight against Alzheimer’s?

Lecanemab (sold under the brand name Leqembi) helps reduce amyloid plaques in the brain, which are hallmarks of Alzheimer’s disease. Prevention’s recent article, “All About Lecanemab, the New FDA-Approved Alzheimer’s Drug,” reports that the drug was approved in January under the FDA’s Accelerated Approval pathway. This process allows the organization to approve drugs for serious…

Key Documents For Your College Kid

A critical item is often missing from back-to-school college checklists — and it could be far more valuable than anything else your student takes to school this fall: signed legal documents.

What’s the Latest on Alzheimer’s Therapies?

The FDA has approved brexpiprazole (Rexulti) opens in a new tab or window for agitation associated with Alzheimer’s disease dementia, the agency announced on Thursday.