Will Moving to a New State Impact My Estate Planning?

However, if you are retired and no longer generating employment income, you should make sure you weigh the financial implications of any potential move.

Which Drugs are Going Up in Price?

Drug price hikes tend to happen at the start of every year, and 2022 is no exception, according to GoodRx.

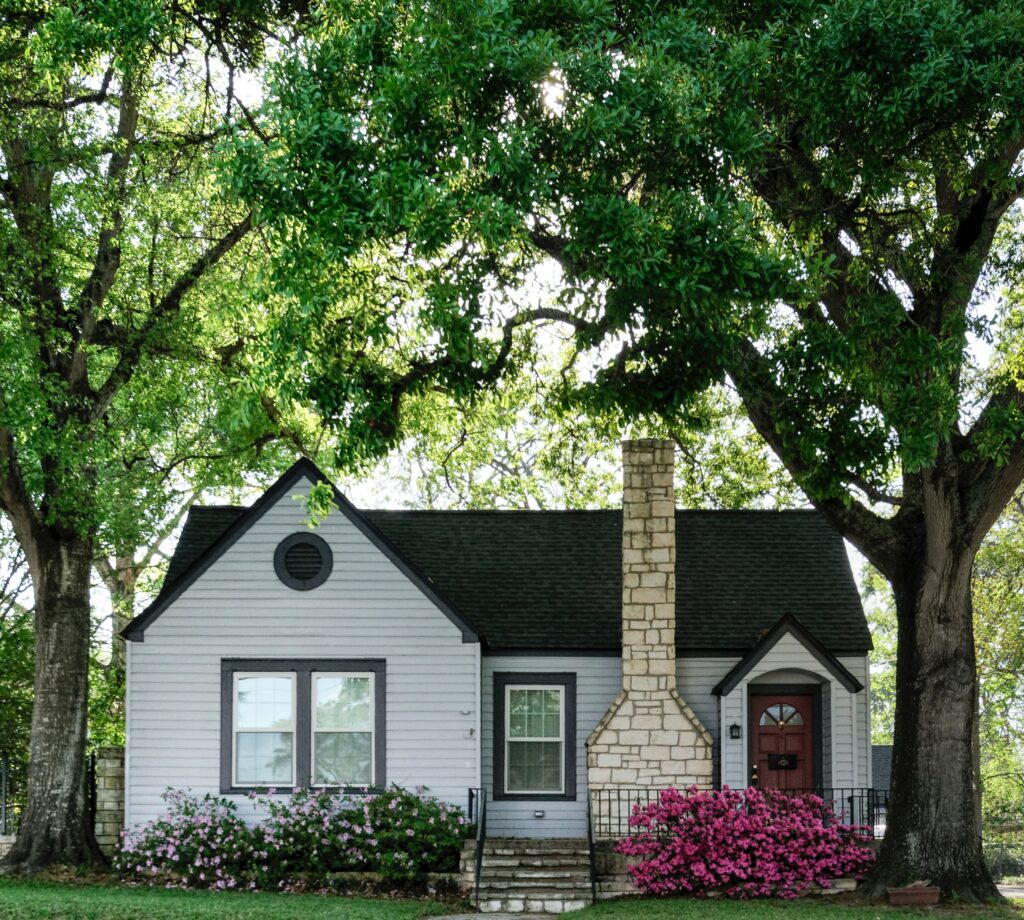

Is Your Home Your Largest Asset or Biggest Liability?

Could generations of traditional homeownership wisdom be wrong? Here’s what you need to know to determine whether your home is an investment that will pay off in retirement—or a liability.

What Planning Should I Do in My 50s?

If you are one of the many people who start getting serious about their finances as they reach their 50s, enjoy this guide for your next steps.

Can I Get More Money with the Build Better Act?

The Senior Citizen League wrote to Congress, requesting that Social Security recipients receive a stimulus check as part of the economic stimulus package.

Ten Tips for Aging Well in 2022.

As 2021 draws to a close, many of us are reflecting on the various ways our minds and bodies have changed over the course of the past year. No matter your phase of life, aging is something we all experience daily.However, that doesn’t mean we’re powerless in the process.

What are Trends in Senior Health Care?

The pandemic was a catalyst for digital health adoption, including in the senior care space. Older adults used video calls to connect with families during lockdowns, and telehealth allowed seniors to meet with their doctors from home. Today’s seniors are more tech savvy than in the past, and this is likely to impact the way they interact with healthcare going forward.

What If Your Nest Egg Runs Dry in Retirement?

Americans say this is where they would turn, if they found themselves in a financial crisis during retirement.

Estate Planning when So Much Is Uncertain

Taxpayers should, of course, carefully consider whether to engage in a lifetime gifting strategy, which has other considerations beyond just estate taxes (such as the tradeoff with the ‘step‑up’ in basis, and non-tax family related considerations).

Is Estate Tax Exemption Going to Change?

The new numbers mean that wealthy taxpayers can transfer more to their heirs tax free during life—or at death. A lot more.