What Do Elder Law Attorneys Do?

Elder law attorneys can help with a long list of legal matters that seniors often face…

What are Biggest Financial Blunders Folks make after 50?

Reaching age 50 is a milestone that most of us celebrate. Still, after you’ve blown out the candles and bid farewell to your guests, you may have a headache from too much champagne, but otherwise feel the same as before.

Don’t Delay Updating Your Estate Plan

Changes in tax law and in your personal life may mean that yours needs to be updated. Here are the easiest (and smartest) ways to do it.

Is There More to Estate Planning Than Writing My Will?

One reason for having a will is to make sure your wishes are carried out. If you die “intestate” (without a will), your assets will be distributed by state law, not by your desires.

Do We Need Estate Planning?

Everyone, regardless of financial status or age, can benefit from having an estate plan—assuming you have assets to leave and people to leave them to.

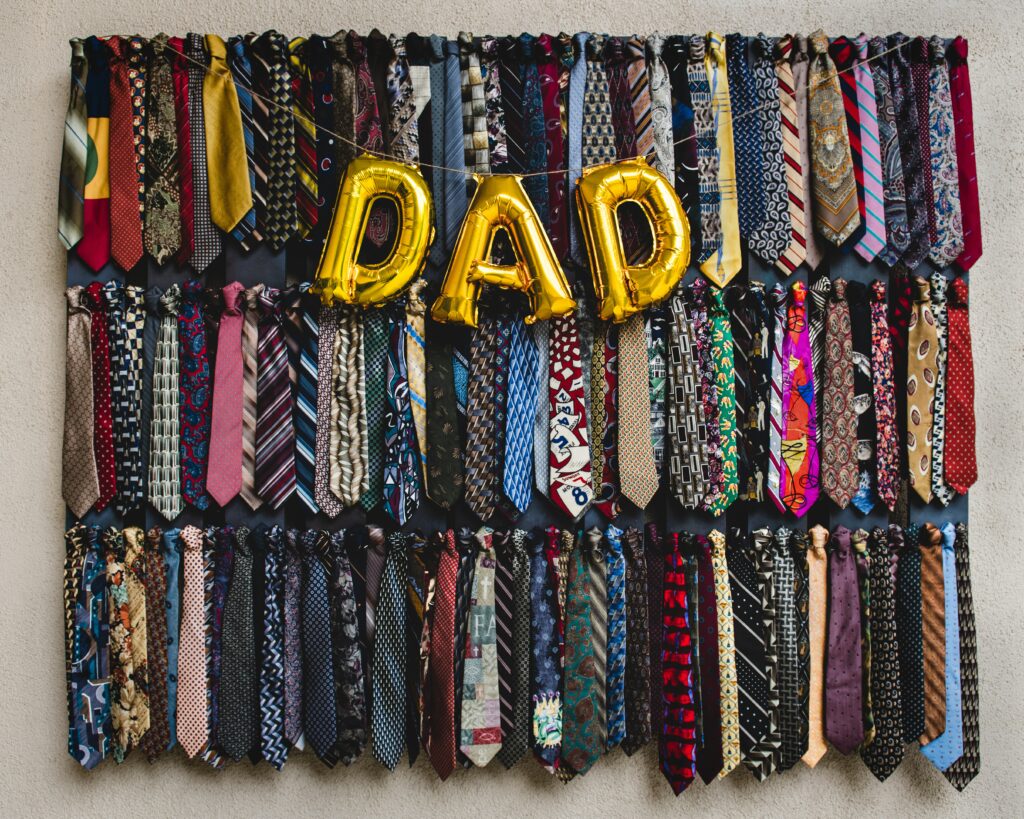

How Fathers Leave a Legacy of Caring

A Father’s legacy includes sharing the values and history of your family. The next time a grandchild points their phone at you and asks you what your childhood was like or asks to learn more about your own parent’s journey, don’t be shy. Tell them the stories you were told, even if you don’t have every single detail.

Some Assets Better Left Outside of Will

That last will and testament you have tucked away? It may not be the last word on what happens to your stuff after you are gone. Instead, that legal document’s directives for doling out your wealth may be overruled by other paperwork and relevant laws.

What Do I Need to Know If I’m Getting an Inheritance?

Heirs receiving an inheritance can expect the process to take time. Having a plan for the money and consulting with professionals are also things to keep in mind.

Who Gets Graceland after Lisa Marie Presley‘s Death?

Lisa Marie Presley‘s surviving three children will reportedly inherit her Graceland estate.

How Safe Are Your Aging Parents?

As the American population of seniors continues to expand, the need for intentional estate planning becomes more urgent, especially for the children of aging parents.