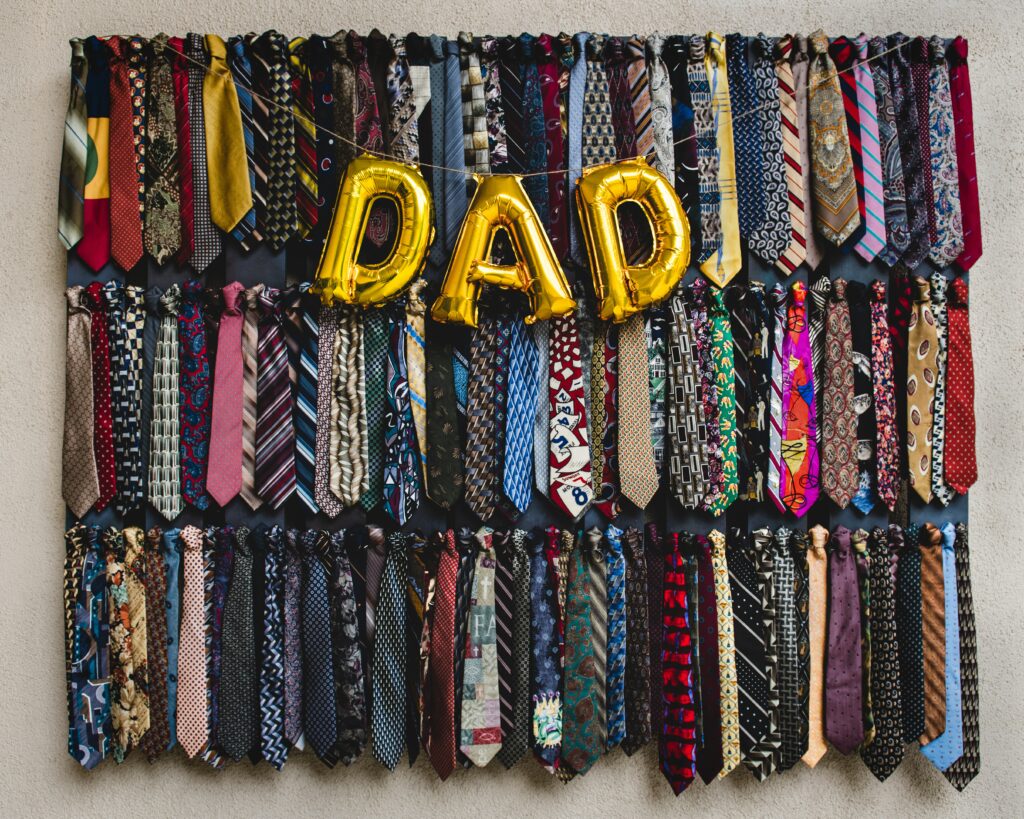

How Fathers Leave a Legacy of Caring

A Father’s legacy includes sharing the values and history of your family. The next time a grandchild points their phone at you and asks you what your childhood was like or asks to learn more about your own parent’s journey, don’t be shy. Tell them the stories you were told, even if you don’t have every single detail.

What Did Kirstie Alley Do for Estate Planning?

Kirstie Alley enjoyed the fruits of her labor following a successful career in the limelight, leaving behind a $40 million fortune and massive real estate portfolio.

Beneficiary Battle over Presley Estate Reveals Possible Problems in Estate Planning

A badly in debt woman dies leaving the proceeds of substantial insurance policies to her children only to have her trust contested by relatives who claim an amendment naming the children as beneficiaries is invalid with no witnesses, misspelled names, suspicious signatures and was never given to previous trustees for review as required by agreement. A long, expensive, and protracted legal battle likely is brewing.

Don’t Miss Out on Estate Planning Opportunities

People often overlook critical steps when they are doing their estate planning.

Are There Less Restrictive Alternatives to Guardianship

Although laws vary from state to state, every state requires that less restrictive alternatives be considered before invoking a guardianship. These might include such vehicles as limited guardianships, powers of attorney or assisted decision-making agreements.

Why Is Beneficiary Designation Important?

When you set up your estate plan it is important to coordinate the legal planning documents that you or you and your attorney create with the document provided by your retirement account custodian and/or your life insurance carrier called a ‘Designation of Beneficiary.’

What Is a Pour-Over Will?

A pour-over will can be an important part of a person’s estate planning checklist.

What Should I Know about Finances Before Remarriage?

You may want to consider some financial issues before walking down the aisle again.

Can I Add Children’s Names to my House Deed?

It’s true that if your child is on your deed as a joint tenant on your home, your home will not have to go through probate if your child survives you. At your death, your surviving child would immediately become the sole owner of your home without probate and with minimal transfer costs.

Now is the Right Time to Approach Parents about Estate Planning

If you have a parent over the age of, say, 65, thoughts about their future may have started to creep into your mind. However, because end-of-life planning can be emotional and overwhelming, it’s tempting to put these conversations off—and even more pleasing to avoid them altogether.