Can End-of-Life Planning Increase Control for Cancer Patients?

An end-of-life program that enables patients with advanced cancer to document their wishes can enhance feelings of life completion, improve relationships with healthcare providers and decrease death-related anxiety, according to a presentation at the 2021 Virtual Association of Community Cancer Centers National Oncology Conference.

What’s Elder Law and Do I Need It?

Why Elder Law Is Necessary? In two words: baby boomers.

Will Moving to a New State Impact My Estate Planning?

However, if you are retired and no longer generating employment income, you should make sure you weigh the financial implications of any potential move.

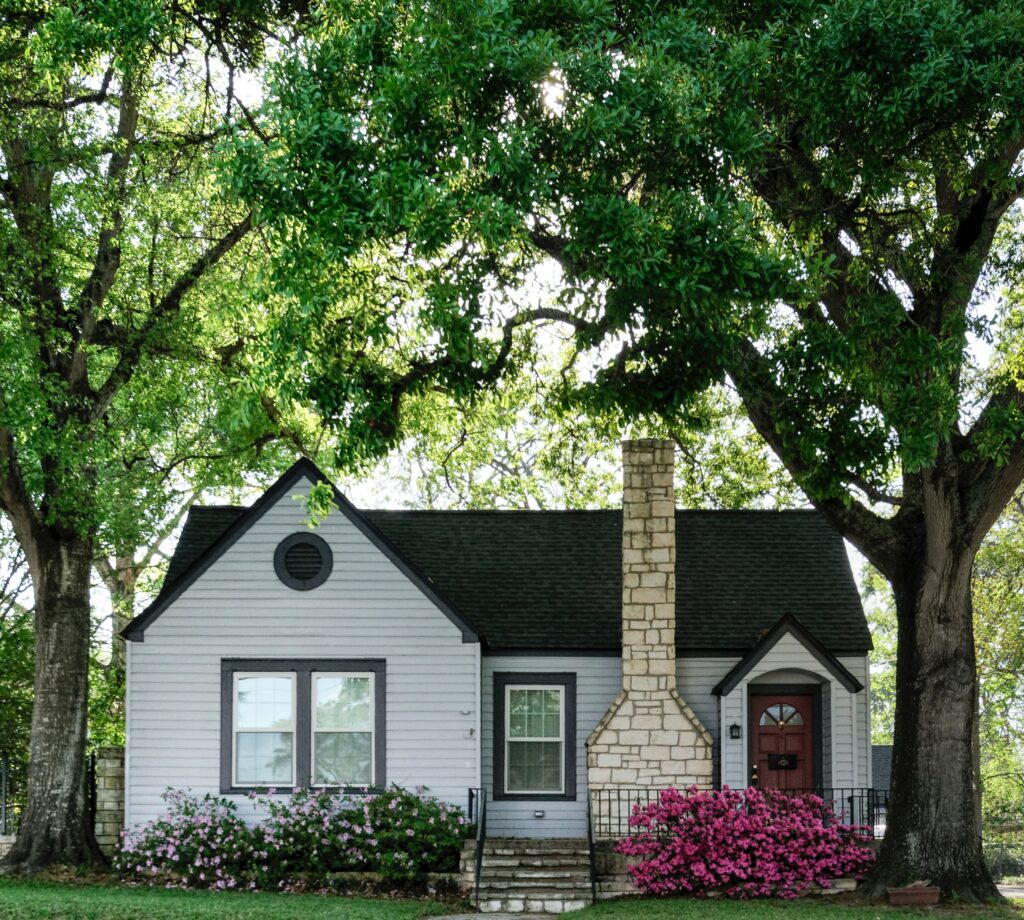

Is Your Home Your Largest Asset or Biggest Liability?

Could generations of traditional homeownership wisdom be wrong? Here’s what you need to know to determine whether your home is an investment that will pay off in retirement—or a liability.

What are Biggest Blunders in Wealth Transfer?

We are approaching the biggest wealth transfer ever, as Baby Boomers prepare to hand off their life savings to their heirs. However, will their heirs actually get the full amount of the wealth intended for them…or will a large amount be lost to unnecessary taxes?

What If Your Nest Egg Runs Dry in Retirement?

Americans say this is where they would turn, if they found themselves in a financial crisis during retirement.

Relieve Regret About Retirement Savings

A 2019 survey by Global Atlantic Financial Group, which sells annuities, asked more than 4,000 Americans, pre-retirees and retirees, about their retirement savings. Of those surveyed, 55% said they had regrets. The top three were that they: Did not save enough. Relied too much on Social Security. Did not pay down debt before retiring. However,…

How Can I Pass Wealth to My Children and Grandchildren?

Inherited assets come with benefits, along with some burdens

Will Inflation Ruin My Retirement?

As America’s economy reopens, we’re seeing higher inflation rates. This unwelcome surge should prompt retirees to consider the threat it could pose to their financial security.

Worst Ways to Withdraw Funds from Retirement Accounts

Withdrawing from your retirement accounts in the wrong order could cost hundreds of thousands of dollars in retirement income.