Choose Wisely When Naming an Agent with a Power of Attorney

Children may have moved away or lost touch. Old contacts may have died or become disabled. You cannot trust everyone and criminal cases based on misuse of a power of attorney do exist.

Don’t Delay Updating Your Estate Plan

Changes in tax law and in your personal life may mean that yours needs to be updated. Here are the easiest (and smartest) ways to do it.

Beneficiary Battle over Presley Estate Reveals Possible Problems in Estate Planning

A badly in debt woman dies leaving the proceeds of substantial insurance policies to her children only to have her trust contested by relatives who claim an amendment naming the children as beneficiaries is invalid with no witnesses, misspelled names, suspicious signatures and was never given to previous trustees for review as required by agreement. A long, expensive, and protracted legal battle likely is brewing.

What Jackie Kennedy Knew about CLATs and Estate Planning

Jacqueline Kennedy Onassis will long be known for many superlative distinctions: an internationally beloved former first lady of the United States, one of the most influential contributors to the restoration and preservation of the White House and a peerless cultural icon.

Are Trusts a Useful Tool?

One type of trust, the qualified perpetual trust, can be used to pass assets down to your beneficiaries, decade after decade.

How to Plan in a Time of Uncertainty

Pandemics, inflation, rising interest rates, war in the Ukraine—uncertain times indeed! And yet, in the world of estate planning, almost every change in the zeitgeist offers its own suite of planning opportunities and applicable techniques.

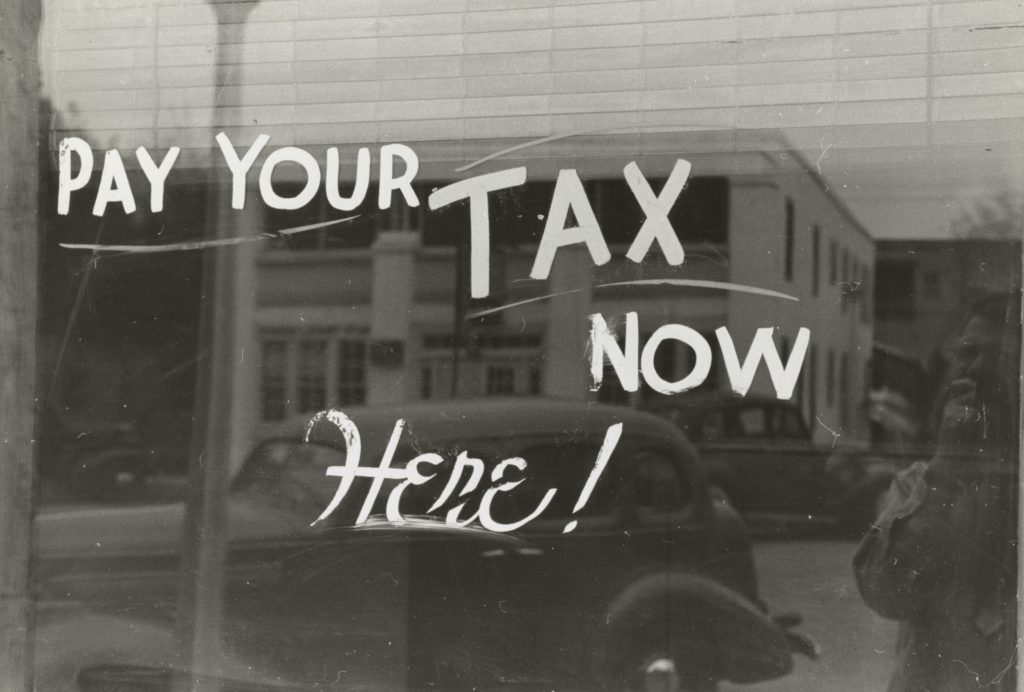

Is Your Estate Plan Ready for Tax Changes?

There are useful estate planning vehicles that take advantage of current historically high federal exemptions, while providing flexibility to adapt and modify those plans based upon future events or tax law changes.

Do You Want to Be an Executor?

Only you know your capacity and willingness to serve, or the degree of need expressed by the person asking you. However, it should help to know first that if you do decide to accept, there can be help out there and second there are standard procedures and practices you can follow.

Do Most People Need a Living Trust?

If you’re putting together an estate plan, you have no doubt heard about the benefits of a living trust.

When Can Estate Assets Be Distributed?

Many estate executors focus on estate taxes and forget about income taxes. That can be an expensive mistake.