Create a Legacy With Your IRAs

Maximize the impact of your legacy and make sure it supports the people and causes that are most important to you.

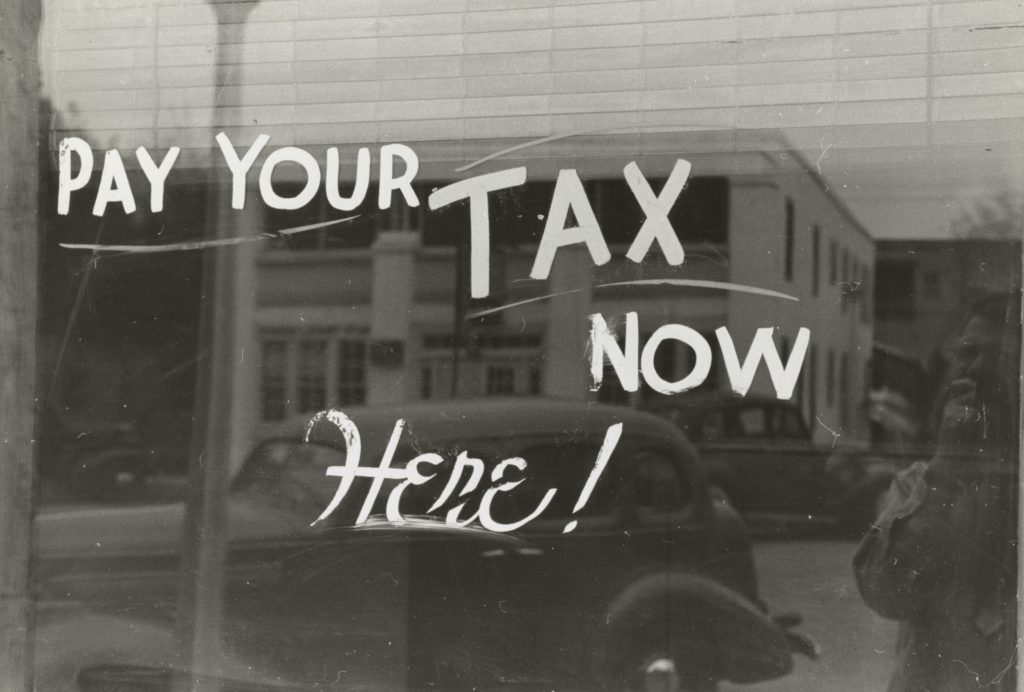

Is Your Estate Plan Ready for Tax Changes?

There are useful estate planning vehicles that take advantage of current historically high federal exemptions, while providing flexibility to adapt and modify those plans based upon future events or tax law changes.

Do You Want to Be an Executor?

Only you know your capacity and willingness to serve, or the degree of need expressed by the person asking you. However, it should help to know first that if you do decide to accept, there can be help out there and second there are standard procedures and practices you can follow.

Living Trust vs. Last Will – Which is Right for You?

In this article, we will address two terms which some people use interchangeably, but which are very different things: living trusts and estate plans.

Why Is Beneficiary Designation Important?

When you set up your estate plan it is important to coordinate the legal planning documents that you or you and your attorney create with the document provided by your retirement account custodian and/or your life insurance carrier called a ‘Designation of Beneficiary.’

What Is a Pour-Over Will?

A pour-over will can be an important part of a person’s estate planning checklist.

When Can Estate Assets Be Distributed?

Many estate executors focus on estate taxes and forget about income taxes. That can be an expensive mistake.

What Legal Terms in Estate Planning do Non-Lawyers Need to Know?

For most people, entering the realm of estate planning can feel a bit like traveling as a tourist into another culture. Because the language itself is unfamiliar, asking a question can result in an answer that is equally confusing.

James Brown Estate Battle Resolved … Almost, but Not Quite

For more than a decade, Brown’s heirs and estate administrators, including Mr. Bauknight and Adele Pope, a former executor, have battled in court over the value of his estate.

Who Should I Name as Trustee?

You created your revocable living trust to hold your assets. You did so because of the probate avoidance and other benefits. You may have included sophisticated tax-planning provisions in your trust.