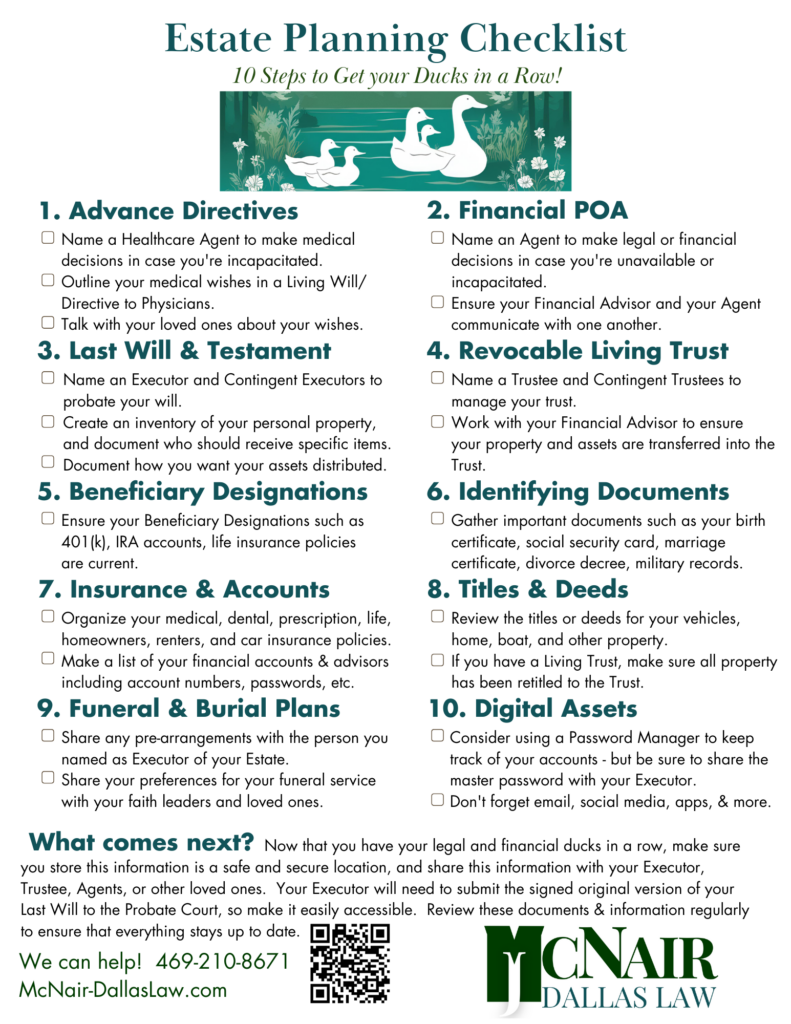

Let’s face it, thinking about the future can be daunting, but when it comes to estate planning, a little proactive effort now saves your loved ones a mountain of stress later. Here’s the ultimate guide to ensure your wishes are known, your assets are protected, and your legacy lives on.

Take Control of Your Medical Care Now and in the Future

- Healthcare Hero: Appoint a trusted friend or family member as your Healthcare Agent (also called a healthcare proxy) to make medical decisions if you’re unable.

- Living Will: Your Medical Wishes, Documented: Create a Living Will (or Directive to Physicians) outlining your preferences for future medical treatment. This empowers your Agent and ensures your wishes are respected.

- Open Communication is Key: Discuss your healthcare wishes with your loved ones, including your Agent and doctor.

Designate Your Financial Powerhouse

- Financial Power of Attorney (POA): Appoint a trusted individual as your Agent under a Financial POA to manage your finances if you’re incapacitated.

- Teamwork Makes the Dream Work: Ensure your Financial Advisor and Agent can communicate seamlessly to manage your assets effectively in the future.

The Will of the People (You!)

- The Executor: Your Right-Hand Man/Woman: Choose a responsible individual (and a backup!) as your Executor to handle the legal process of distributing your assets according to your Will.

- Asset Inventory: A Treasure Map: Create a detailed inventory of your belongings, specifying who inherits what. Think sentimental items beyond just bank accounts!

- Clarity is King (or Queen): Outline your desires for asset distribution in your Will. Transparency avoids confusion later.

Living Trust: A Step Ahead

- The Trustworthy Trustee: Appoint a reliable Trustee to manage your assets held within the Living Trust.

- Planning Pays Off: Work with your Financial Advisor to ensure all relevant assets are properly transferred to your Living Trust. This can streamline the probate process for your beneficiaries.

Beneficiary Designations: Double-Check, Breathe Easy!

- Review and Update: Verify that beneficiaries for retirement accounts, IRAs, and life insurance policies are current.

Gather Your Important Documents

- Birth Certificate, Social Security Card, and More: Locate and organize crucial documents like birth certificate, social security card, marriage license, etc. This makes life easier for your loved ones.

- Lastly: Your Executor will need the original, signed version of your Last Will, so ensure they know where to find it, and can easily access it when they need it in the future.

Insurance & Accounts: Keeping Track

- Organize Your Policies: Keep all your medical, dental, prescription, life, home, and car insurance policies neatly organized.

- Financial Snapshot: Create a list of your financial accounts, usernames, passwords (securely!), and contact information for your advisors.

Titles & Deeds: Ownership Matters

- Verify Ownership: Review titles or deeds for your property (house, car, boat) and ensure they match your estate plan.

- Living Trust Advantage: If you have a Living Trust, ensure all titled property is re-titled in the Trust’s name.

Funeral & Burial: Your Final Wishes

- Planning Ahead Saves the Day: Share any pre-arrangements with your Executor about your desired funeral or burial service.

- Open Communication with Loved Ones: Discuss your preferences with family and faith leaders for post-life ceremonies.

Don’t Forget the Digital World!

- Password Management: Consider a password manager for online accounts, but designate someone to inherit the master password securely (think sealed envelope with your Will or shared with a trusted third party).

- Social Media & Beyond: Extend your plan to include social media accounts, email, and other digital assets.

Remember:

- Secure Storage: Find a safe place to store your documents (fireproof safe or secure online storage). Inform your Executor and other designated individuals about the location.

- Accessibility Matters: Ensure your Executor can easily access the original signed Will for probate court.

- Regular Review: Like a car, your estate plan needs regular checkups. Review and update your documents as your life changes.

With this comprehensive checklist, you can confidently conquer the chaos of estate planning. By planning now, you ensure your wishes are respected, your loved ones are protected, and your legacy shines brightly. Contact our office today to get started.