There are a number of benefits available to veterans, including some critical ones you determine toward the end of your service.

Military Times’s instructive article entitled “Change of Mission: Understanding your VA benefits at separation” explains that failing to address these benefits or making the wrong choice could cost you down the road or force you to leave a lot of money when you exit. Here are some major benefits regarding which veterans typically make consequential mistakes:

Post-9/11 GI Bill. If there is a chance that you’re not going to use the Post 9/11 GI Bill for your own education, be sure you transfer this to your immediate eligible family members. You can only do this while you are still in uniform, and it will come with an additional service obligation of four years. This represents a free college degree that could otherwise cost $100,000 (or more), if you fail to do this ahead of time.

VA Life Insurance. Your $400,000 of Servicemembers’ Group Life Insurance (SGLI) coverage ends 120 days after you separate. You can replace SGLI with Veterans Group Life Insurance (VGLI), and if you are retiring, you can sign up for the Survivor Benefit Plan (SBP), which passes on 55% of your pension to your surviving spouse or eligible beneficiaries. Note that if you’re healthy, you can find a cheaper policy with a higher payout from a private insurer. However, start the process WELL BEFORE you start file a VA disability claim. If you get this backwards, you could find yourself uninsurable, or your premiums will be extremely high.

VA Disability Claim. No one’s going to force you to file a claim with the VA. However, take the time to do this if needed. It’s important to get any service-connected health issues and injuries thoroughly documented while you’re still in uniform. Otherwise, this could be a fight when you retire from duty. Make sure that your medical records are complete and accurate. When you’re six months from separation (no earlier), give a copy of your records to an accredited Veteran Service Organization (VSO) to represent you and assist with navigating the VA claim process (they do this as a free service). The VA will determine your disability rating after your separation, which could take a few weeks or months. Don’t count on getting a VA disability check for income, until after you get a rating.

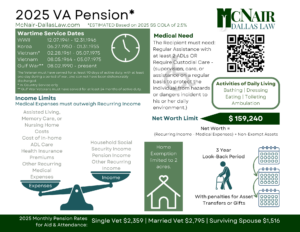

VA Pension. Pension is a cash award available to eligible to war-time veterans, and their surviving spouse. Recipients must require assistance with personal care activities, and the cost of care must be higher than the monthly income to receive the full benefit. This benefit can help qualified veterans offset the cost of care, and extend their retirement resources.

In 2025, Monthly VA Pension Awards are projected to be $2,795 for a Married Veteran, $2,359 for a Single Veterans, and $1,516 for Surviving Spouses.

In order to qualify for VA Pension (sometimes called Aid & Attendance), the Veteran must need regular assistance with at least 2 Activities of Daily Living (bathing, dressing, eating, toileting, or ambulation). The cost of their care must also outweigh their recurring income, and they must have a Net Worth less than a projected $159,240.

For more information about Veteran’s Pension or other benefits, contact our office or book a call today.

Reference: Military Times (Sep. 2, 2021) “Change of Mission: Understanding your VA benefits at separation”