Do You Want to Be an Executor?

Only you know your capacity and willingness to serve, or the degree of need expressed by the person asking you. However, it should help to know first that if you do decide to accept, there can be help out there and second there are standard procedures and practices you can follow.

Can My Gun Collection Be Part of Estate Plan?

Firearms are unique in this regard; guns are the only item of personal property that carry an inherent risk of legal peril, including potential criminal liability, so careful and deliberate planning is warranted.

Living Trust vs. Last Will – Which is Right for You?

In this article, we will address two terms which some people use interchangeably, but which are very different things: living trusts and estate plans.

What Is the Best Way to Leave Money to Children?

Providing for future generations shouldn’t be (overly) taxing. To manage taxes as you pass down your assets, look into UTMAs, 529s, child IRAs and trusts.

What Is a Pour-Over Will?

A pour-over will can be an important part of a person’s estate planning checklist.

Do Most People Need a Living Trust?

If you’re putting together an estate plan, you have no doubt heard about the benefits of a living trust.

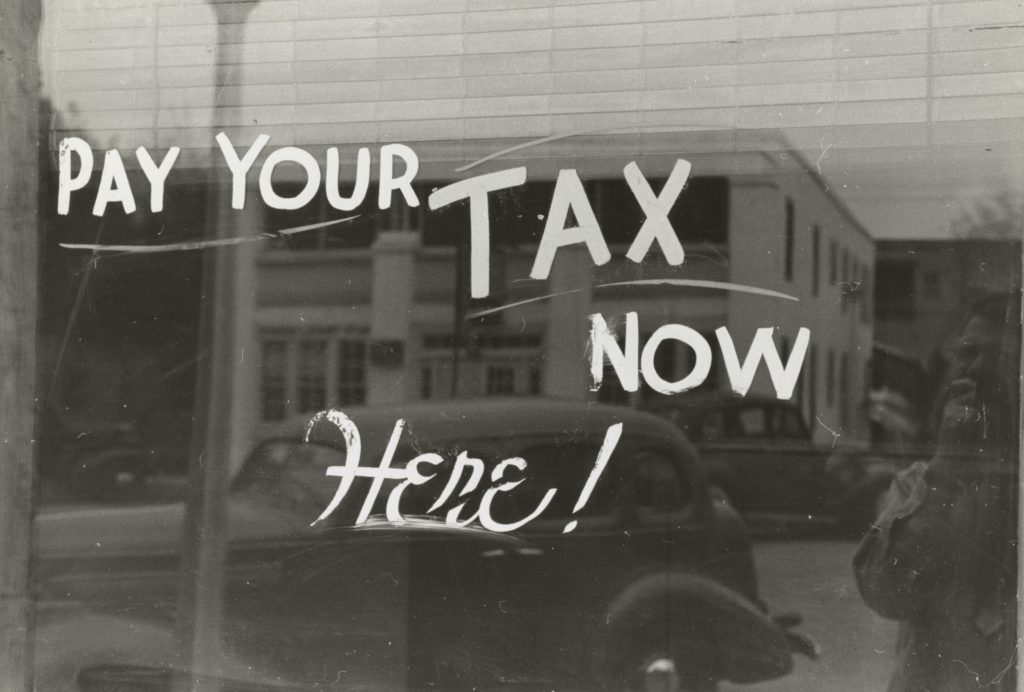

When are You Required to File a Gift Tax Return?

The IRS wants to know how much you’re gifting over the course of your lifetime. This is because while gifts may be based on generosity, they are also a strategy for avoiding taxes, including estate taxes, reports The Street in a recent article “Do I Need to File a Gift Tax Return?” Knowing whether you…

What Happens to a Pet when Owner Dies?

While it’s never fun or pleasant to think about what will happen to them if the worst should happen to us, it’s very important to consider how we can ensure that they are well cared-for when and if we are no longer able to care for them ourselves.

How Best to Use Life Insurance Proceeds?

There are many options, but the best use of the money is different for each widow and her unique circumstances.

When Can Estate Assets Be Distributed?

Many estate executors focus on estate taxes and forget about income taxes. That can be an expensive mistake.