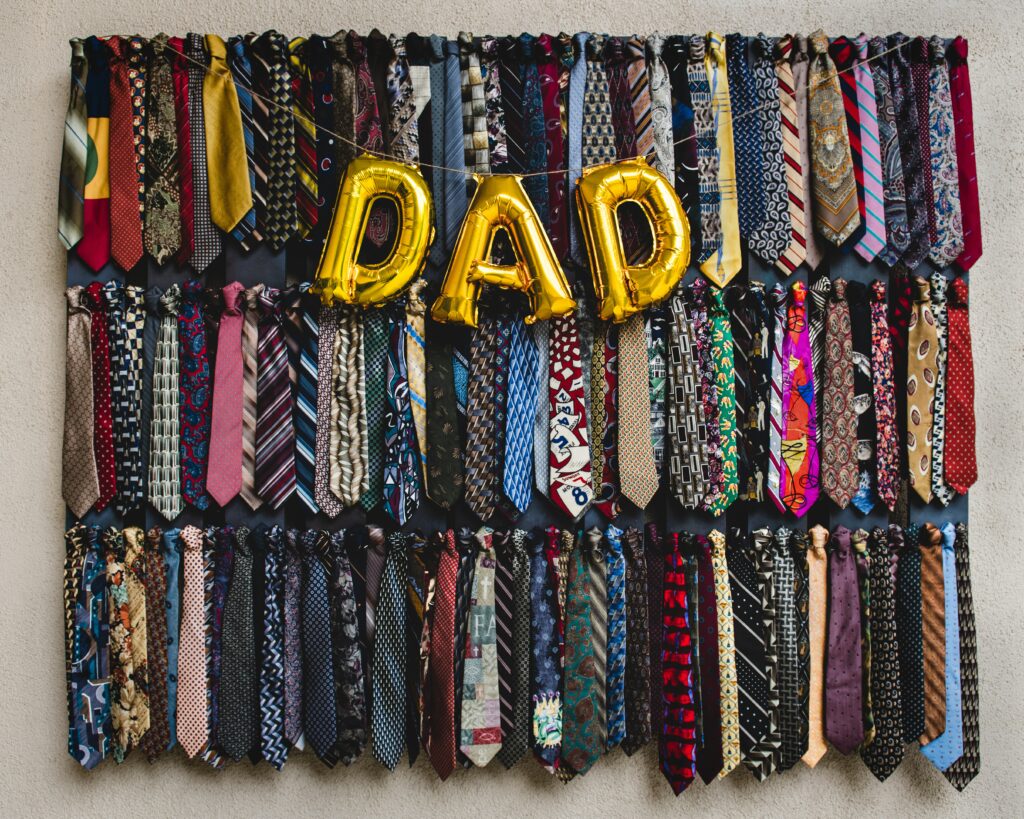

How Fathers Leave a Legacy of Caring

A Father’s legacy includes sharing the values and history of your family. The next time a grandchild points their phone at you and asks you what your childhood was like or asks to learn more about your own parent’s journey, don’t be shy. Tell them the stories you were told, even if you don’t have every single detail.

What are the Consequences of Dying Without a Will?

When you die, a section of law known as estate and probate law governs how your assets are distributed.

Can We Learn from the Presley’s Estate Fight?

Priscilla Presley’s fight to remain trustee of Lisa Marie Presley’s trust can teach anyone a few lessons on proper estate planning.

What Is a Life Estate?

A life estate is a type of property ownership or tenancy that grants an individual the right to use and enjoy a property for the remainder or their life. It gives an ownership interest to someone else.

Is Surviving Spouse Automatically Your Beneficiary?

If the surviving spouse is a second or subsequent spouse and did not have any children with the decedent, the surviving spouse takes even less.

How Trusts Help with Asset Protection

The idea of asset protection for the purposes of protecting against long-term care costs is becoming both more sought-after and more necessary.

Some Assets Better Left Outside of Will

That last will and testament you have tucked away? It may not be the last word on what happens to your stuff after you are gone. Instead, that legal document’s directives for doling out your wealth may be overruled by other paperwork and relevant laws.

What are Medicaid Spousal Impoverishment Numbers in 2023?

The Centers for Medicare and Medicaid Services (CMS) has released the 2023 federal guidelines for how much money the spouses of institutionalized Medicaid recipients may keep.

What Do I Need to Know If I’m Getting an Inheritance?

Heirs receiving an inheritance can expect the process to take time. Having a plan for the money and consulting with professionals are also things to keep in mind.

Who Gets Graceland after Lisa Marie Presley‘s Death?

Lisa Marie Presley‘s surviving three children will reportedly inherit her Graceland estate.