Make Life Easier for Heirs: Get Your Estate Organized

It’s easy to put off doing many of these things. However, get them done, and your heirs will be thankful you did.

Organize Your Important Papers and Get Personal and Financial Affairs in Order

The first step in getting your affairs in order is to gather up all your important personal, financial and legal information, so you can arrange it in a format that will benefit you now and your loved ones later.

Can an Elder Law Attorney Help Me with Medicaid?

How can an elder law Medicaid attorney help?

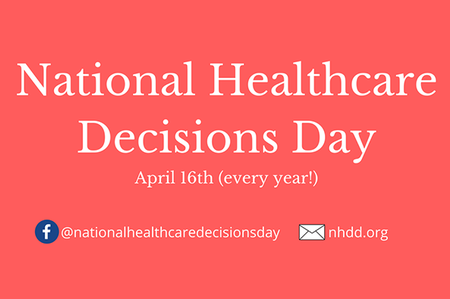

National Health Care Decisions Day Inspires Vital Conversations

National Healthcare Decisions Day is April 16th. Take this opportunity to talk with your loved ones about your healthcare wishes.

Can Estate Planning Reduce Taxes?

Upstream basis planning is a trust strategy that can save wealthy people on their capital gains taxes and income taxes associated with highly appreciated assets.

How to File Tax Return When Mom Passes Away

No one likes doing taxes, but the task is even more daunting when filing a return for someone who has died.

What are the Causes and Risk Factors of Parkinson’s Disease?

There are several known causes of Parkinson’s disease (PD). This condition is associated with decreased amounts of dopamine in a small area of the brain called the substantia nigra and in its projections to the basal ganglia (deep nuclei inside the brain).

How Can I Be Better Long-Distance Caregiver?

Long pandemic lockdowns forced many older adults to become comfortable with video calls to stay connected with family. That, in turn, means that long-distance caregivers have a better way to see how their loved ones are faring.

What are Top ‘To-Dos’ in Estate Planning?

The biggest misconception people have about estate planning is that “they are not that old and can do it later,” say almost half (49%) of advisors in a recent Key Private Bank Advisor Poll on estate planning. Yet, the majority (73%) of advisors say the ideal age to start putting an estate plan in place is before 40—earlier than many people think.

Avoid Errors with Special Needs Planning

Estate planning should always be customized to each individual creating a plan. This is particularly important when planning for beneficiaries with disabilities.