Expensive Health Problems Often Diagnosed after 50

As we age, health issues often creep up that threaten to tarnish our golden years. Treating some of these diseases and conditions can be expensive.

Why Should I Have a Living Will?

As a review of terms, a will is a legal document that specifies how a person’s estate should be handled only after that person’s death. A living will has nothing to do with how your “things” like property, money, jewelry, etc. are to be distributed. Unlike a will, it is, in fact, a document that comes into play while you’re still alive.

How Do I Conduct an Estate Sale?

Preparing for an estate sale can be a difficult and emotionally challenging task.

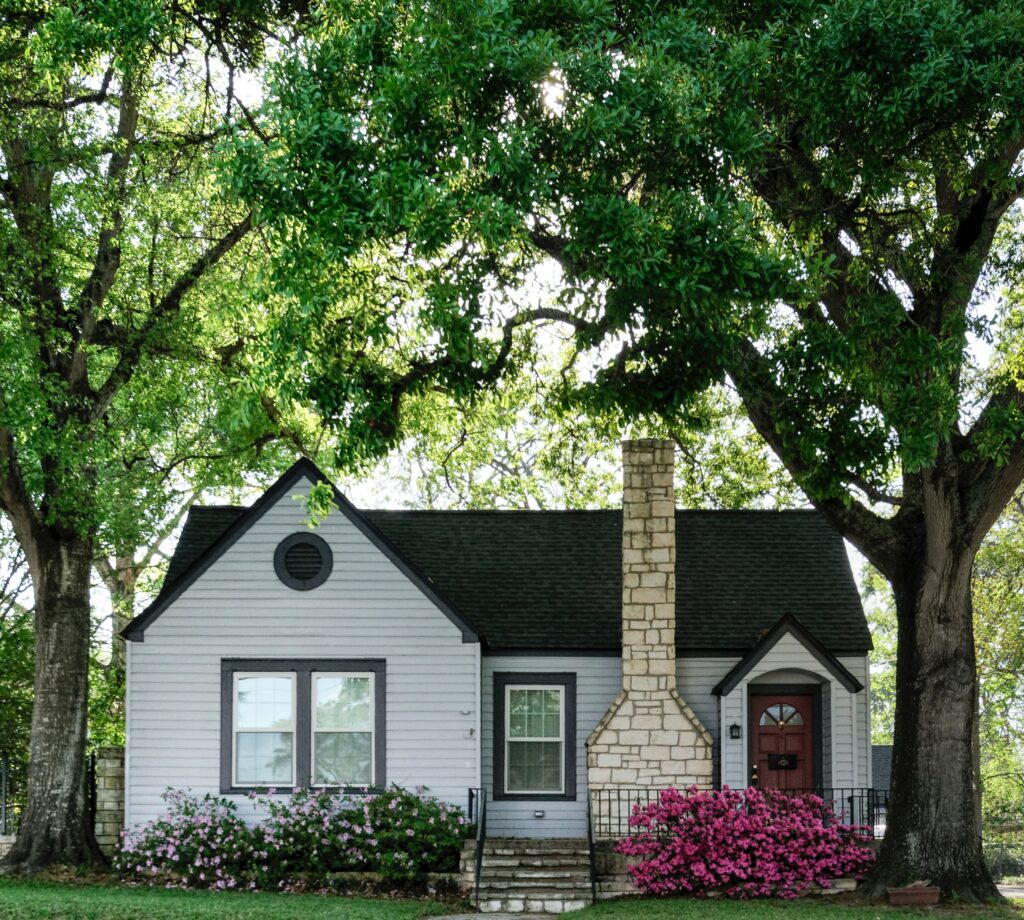

Is Your Home Your Largest Asset or Biggest Liability?

Could generations of traditional homeownership wisdom be wrong? Here’s what you need to know to determine whether your home is an investment that will pay off in retirement—or a liability.

How Do I Hire a Caregiver from an Agency?

Once you have a list of promising agencies, arrange a consultation. AARP has a checklist of important questions to ask before signing a home health contract.

Can I Restructure Assets to Qualify for Medicaid?

Several types of special income trusts and other strategies can be helpful, when trying to protect your family’s assets from the devastating costs of long-term care.

Any Ideas How to Pay for Long-Term Care?

The costs of long-term care for older adults can be significant. Federal Medicare health insurance benefits do not cover most of these costs. Most people who incur costs for long-term care cover them with a combination of personal savings, long-term care insurance and Medicaid, among other sources.

How Do I Know If Dad Needs Personal Care Help?

Relationships can be complicated under the best of circumstances. However, when you see someone you love — like an aging parent, grandparent or close friend — struggle to take care of their health, stepping in isn’t always so simple.

How to Protect Assets from Medicaid Spend Down

Several types of special income trusts and other strategies can be helpful when trying to protect your family’s assets from the devastating costs of long-term care.

What Has COVID Taught Us about Caregiving

The COVID-19 pandemic increased demand for and complexity of care, accelerating existing trends toward longer duration and more acute long-term care.